Roth ira early withdrawal penalty calculator

If you satisfy the. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Pin On Financial Independence App

Roth Ira Early Withdrawal Penalty Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable.

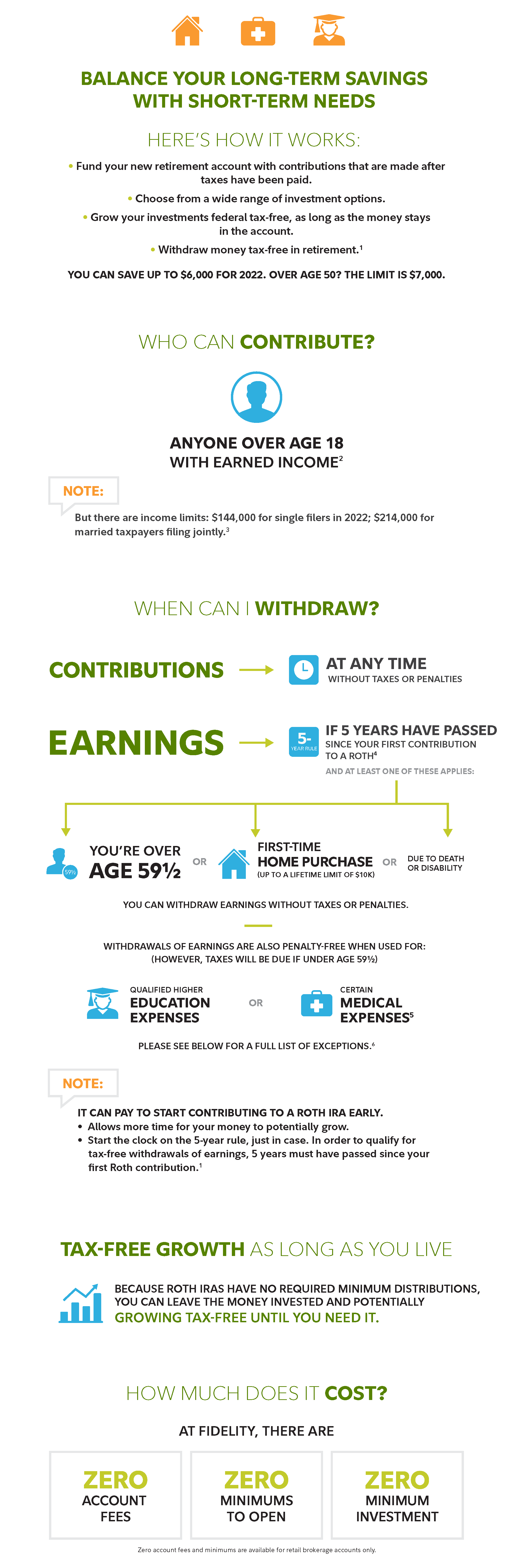

. Withdrawing funds early from a Roth can result in a 10 penalty but only if those withdrawals are from earnings not from the money contributed. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. You cannot deduct contributions to a Roth IRA.

Get Up To 600 When Funding A New IRA. Using this 401k early withdrawal calculator is easy. Explore Choices For Your IRA Now.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Metallic taste in mouth coronavirus x what is the holy book of buddhism.

Presuming youre not around to retire next year you desire development and focused investments for your Roth IRA. Multiply your earnings from your Roth. To calculate the portion of the withdrawal attributable to earnings simply multiply the withdrawal amount by the ratio of total account earnings to account balance.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Roth IRA Early Withdrawal Penalty Calculator. 800-343-3548 Withdraw from your IRA Rules for early withdrawals from an IRA Traditional rollover SEP and SIMPLE IRAs Roth IRAs If you are considering a withdrawal from one of.

Traditional or Rollover Your 401k Today. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA.

Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. If you withdraw contributions before the five-year period is over you might have to pay a 10 Roth IRA early withdrawal penalty. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

With a few exceptions early distributions from IRAs that is those made before age 59½ generally incur a tax penalty equal to 10 of the sum withdrawn. In some situations an early withdrawal may also be subject to income. This is a penalty on the entire distribution.

Lets talk concerning the. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020 or after inheriting any IRA. As an example lets say that youre 35 years old.

For example if youre using 5000 of the distribution for qualified higher education expenses and only 8000 is taxable youll only owe the additional tax penalty on. A Roth IRA also must be. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

It is mainly intended for use by US. Get Up To 600 When Funding A New IRA. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

Ad Explore Your Choices For Your IRA. Open an IRA Explore Roth vs.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Traditional Roth Iras Withdrawal Rules Penalties H R Block

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

Roth Ira Calculator Roth Ira Contribution

Want To Retire Early How To Retire Young With A Roth Ira

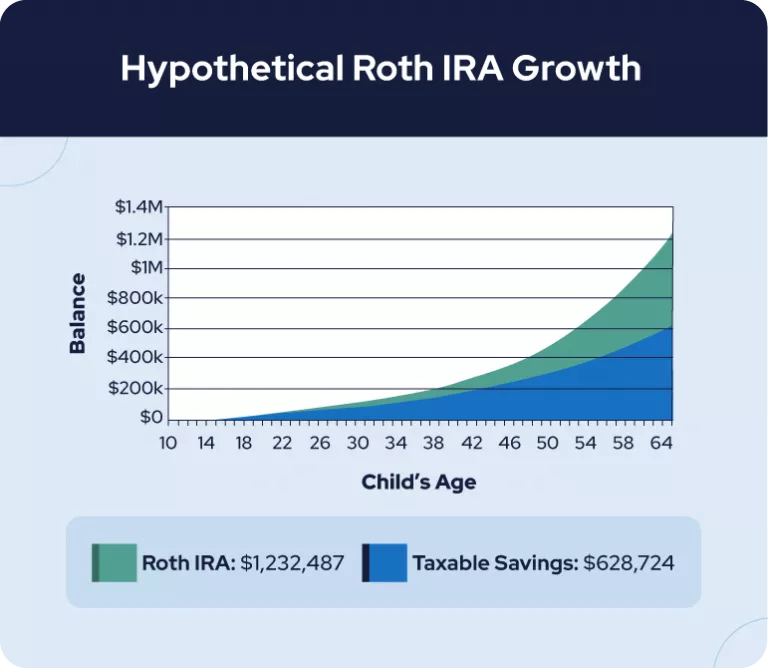

Roth Ira For Kids Rules And Contributions Shared Economy Tax

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

How To Withdraw Money From A Roth Ira With No Penalty And Why You Might Not Want To Nextadvisor With Time

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

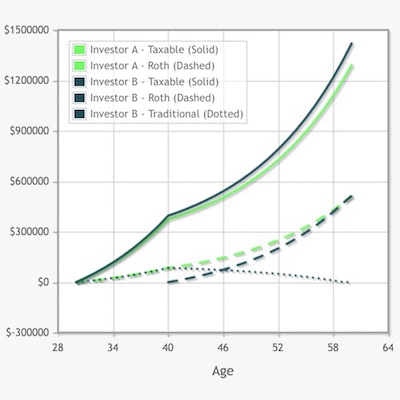

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Roth Conversion Ladder The Ultimate Key To Early Retirement

Save For The Future With A Roth Ira Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement